Welcome to the first issue of Deck Review with The Labyrinth.

While I’m sure most folks reading this will have seen plenty of resources in the past on building a great pitch deck, two of the best are this basic template from Sequoia Capital and “The Greatest Sales Deck I’ve Ever Seen” from Andy Raskin. If you haven’t read them before I strongly encourage you to do so now.

I don’t want to repeat any of the common wisdom but before we dive in to our first deck here are a few basic pointers:

1) Keep it simple, keep it keep it short: Docsend found that VCs spend an average of 3 minutes and 44 seconds on your deck but that successful decks tend to be closer to 2 minutes.

If you have 10 slides that means anywhere from 12 to 22 seconds spent per slide. If you have 30 slides we’re talking 4-7 seconds per slide. KEEP IT SIMPLE.

2) Remember the goal: Your pitch deck will not secure you an investment. It just won’t. The goal isn’t to convince the reader to invest in you, it’s to convince them to take a meeting with you and to take it seriously. What this means is that you don’t need to include every single detail in your deck, only enough to explain what you do and why its going to be a great business.

3) Remember your audience: You are probably pitching to a venture capitalist or angel and they are likely motivated by financial returns. At the end of the day your problem/solution/team are just features, the real value proposition you are pitching them is a financial return. One common mistake is to spend too much time on the nuances and features of your product or too much time focusing on the market. We’ll get into that during a meeting but its wasted time/space in your pitch deck. Make sure your story gets across the financial opportunity.

4) Leverage Emotion: Investors try to make investment decisions in a dispassionate way but ultimately we’re human and emotion influences decision making… particularly early on in the process. Tugging on heart strings might not get you past the investment committee but its highly likely to buy you the time and attention you need to get in front of the investment committee. How do you do this? Make the problem you’re trying to solve personal to you (employ empathy) and make the problem land viscerally for the investor (familiarity). If the problem is too abstract to the investor, then do it through storytelling so that the investor can put themselves in the shoes of the protagonist.

*During a pitch meeting you’ll know when you’ve accomplished this because the pitch shifts into a you & the investor vs the problem dynamic instead of a you vs the investor dynamic. It’s palpable.

Now lets dive into this week’s deck (If you have any constructive criticism, please leave a comment/reply):

Great cover slide. Sets context for what I am about to see next and is visually interesting.

I have zero idea what is going on here. Post apocalyptic + kids with a map? Am I missing a pop-culture references? I just don’t know. I’m confused and that’s a bad thing. What are you trying to convey?

Cute slide, makes sense, shows that the mission is personal to you (key)

The second pic is a little dark/hard to see

Pretty generic and doesn’t convey much more information than the last slide.

3 slides on “Why am I doing this” is 2 too many. Remember on average investors are spending less than 4 minutes on the deck which means a material number are spending less than 2.

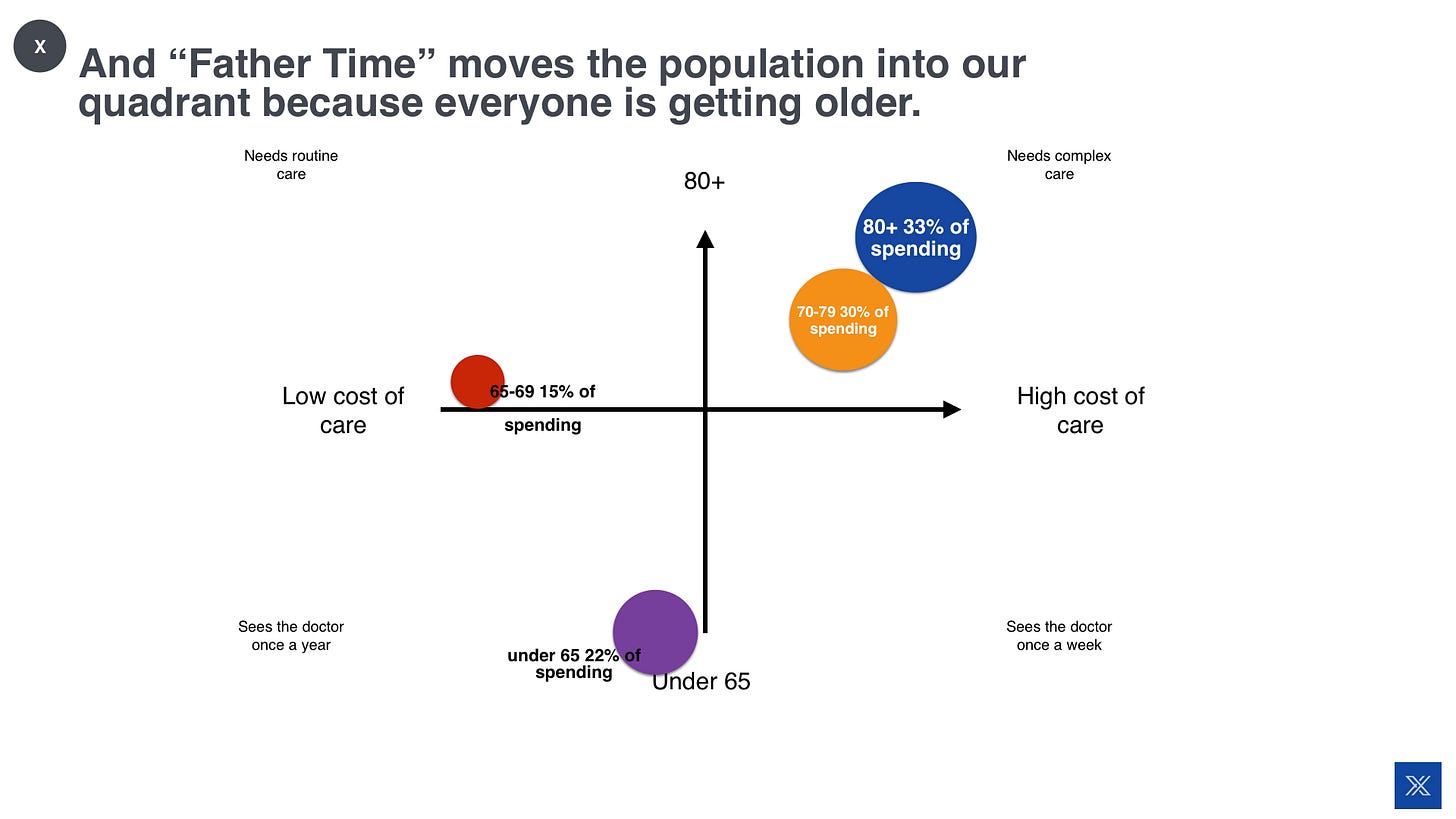

Great slide. Huge problem about to hit and something most of us can intuitively empathize with.

Good driving home the scope of the problem and your available market. Also provides some details on who your target market is.

Ok, still helpful to see this data for outlining the problem but 3 slides is definitely too much. You need to get this down to (a) lots of people will need complicated care and (b) the system can’t meet the demand. Maybe even 1 slide. The rest of the data from these slides can go into an appendix at the back.

Busy… maybe that is the point…ok

This image doesn’t actually tell us what you do. Its a bit confusing if you don’t provide context first. As an investor reading this I’d spend no more than 1 second here and move to the next slide looking for context which probably means you should just pull this slide out.

This slide is just a repetition of the slide 2 above with a different graphical representation. Pick one and go with it.

Same criticism. This slide replicates the slide 2 above with a different graphic. You need to consolidate these. I like the conductor image better its more relatable for folks who aren’t in the healthcare space.

This feels like a hard pivot in your story arc. I still have no idea what you do and now you’re telling me about your market segment but didn't we talk about the market a bit 4 or 5 slides ago?

Right now I think you have an app that is a messaging and project management app for the healthcare space but that is a total guess. You also were talking about a bed shortage so maybe you have a more direct solution for that. Well you’re digital and talked about care at home so probably not a real estate play but maybe something like Honor… home healthcare services? I really don’t know yet.

Great, I’m still lost and you can 100% find a way to combine this slide with the prior one.

Another market slide, this zooms way back out. I’m already convinced the healthcare market is huge, already convinced home healthcare is big, this seems unnecessary and again is weird for the narrative. We start zoomed out early in the deck, then zoom in on the quadrants and are now zooming out again. Too much and too disjoined.

I’m glad you include a go to market slide. Its an important topic to cover and many don’t but I still don’t really know what you do.

Unfortunately, this slide isn’t really a go to market slide. Its great for the appendix to answer my diligence question… “how do you decide where to go next” but doesn’t show how you penetrate any particular market. Instead tell me “we launched in Houston in 2019 using craigslist, Angies list and care.com to find home care providers and offering value proposition X and Y” We’ve found that our blended CAC is ~$75 through these channels. We’re expanding to Dallas next with a similar message, etc. (This is obviously too much text or a slide but this is the type of info to convey in this slide).

This slide makes sense for go to market if the strategy is buying existing businesses and rolling them up with some software to make them more efficient as a primary strategy. If you intend to launch/grow organically first, then this should be an appendix slide. Either way the prior slide should be appendix.

If acquisitions are a primary growth strategy, the appendix should list a few target companies you’re acquiring or have acquired already and what that looks like.

This is all duplicative. If the story is tight you don’t need to repeat anything, I should be able to intuitively grasp it.

Duplicative, you should definitely remove from the deck.

This slide is similar to the 6th slide and unnecessary… although it might be better than your 6th slide.

The market data aspect of this slide is unnecessary as we’ve covered it in such detail previously in the deck.

The third paragraph on this slide “By professionalizing operations and building a multi-agency platform we increase enterprise value significantly” Is the first time that you’ve explicitly defined what it is that you do. It comes waaaaaay too late in the deck and is way too buried. This needs to be made clear by slide 5 or 6 at the latest. After you make this general statement clear give me the 2-3 features of your product that actually accomplish what you claim to be accomplishing. i.e. messaging platform, or task management or simplified billing or whatever it is.

Most investors don’t care about “combined experience” numbers or aggregate deal numbers. They are so easy to manipulate and mean very little for the business. If you’ve founded a company before and had a successful exit, say it, otherwise just focus 1-2 bullets on your relevant experience.

Spend more space on your team and less on advisors. Most investors don’t care about your advisors unless they know one of them and can reach out for a backchannel chat. The reason is that almost every deck I see is loaded with impressive advisors and almost every company we work with speaks to their advisors at best once every six months.

Unfortunate but true… if you have well known investors already you get more bang for your buck listing them out then listing your advisors.

More market data…. ugg

Nice summation. Not a bad last slide but I think you’d get more by having a slide like this early on to help the reader understand what it is that you do, then at the end of the deck you could include a summation like this but cut the text in half. At this point I should have enough context that a couple bullets is all you need.

Final Thoughts

This deck is too long, the narrative arc jumps around a bit, half the deck is spent talking about the market and even after reading through the whole thing I have only the vaguest idea of what Canexia does. That is the bad news. The good news is these problems are easily resolved and this company is solving a problem to which we should all be able to relate. There is hope!

I’d love to welcome you to visit The Labyrinth and share your own advice / recommendations to the Canexia team. Lets help them figure this out.

Cheers,

Jake

Jake, thank you for the feedback! Fortunately, I have a bunch of iterations on the deck along with a history of the changes.

The deck you're looking at is a result of what I call "spinning in a vacuum". Meaning, we all need advice and guidance. And, unfortunately, it lives a-plenty online. Most of it is shit.

Version 6 (this version) was the result of modeling Front's Series B deck. Not saying their deck was shit, rather the 'inside baseball' is what made it work, not some magic format.

The mistake I'm NOT going to make is saying "well Front raised X so I'm just going to go with it"

New, tighter deck in the works.

New deck is 12 slides moving to 10.

Related to this discussion: https://fs.blog/2019/01/how-not-to-be-stupid/. It's 10 minutes well spent.

I've spent far too long writing copy and making presentations. This deck was the result of an overloaded schedule and taking the easy way out. Plus, I forgot one of the top rules of writing any sort of sales copy: Know what the copy is trying to accomplish. (Jake's point #2, above)

A close second was the way Jake described "zooming in and zooming out". I never would have looked at the story arc that way. Closely tied to it was what we call "the greased slide" in writing sales copy. The person hearing/reading should slide from the first slide right to the call to action (take a meeting, this is worth your time, your team's time, it's less risky than the other 2,143 deals you've seen, you won't look stupid pitching this to the committee)