In this week’s deck review I’ll open with why Venture Capital might be the perfect place to deploy capital during the current crisis.

On Thursday I'm publishing an interview with @VCStarterKit, AKA “Let Me Know How I can be Helpful” one of the more insightful anonymous venture capital satire accounts. Make sure to subscribe if you don’t already so you don’t miss the interview.

Corona Virus; a great time for VC investing?

At the moment nobody really knows where the Corona virus is going. Are we sheltering in place for 1 more month (waaaay optimistic) or are we going to experience rolling shelter in place orders for the next 18+ months while we wait for a vaccine. This extreme uncertainty is being played out for all to see in the public markets but its having plenty of impact across asset classes.

First, I want to be clear that Covid-19 is a disaster for the world and its direct effects are a huge net negative (though my optimistic side hopes the second and third order effects on the post-Covid-19 world are net positive). I am not being callous but as we all must figure out how to proceed through Covid-19 and eventually to live in a post-Coved-19 world… here are some of my thoughts on why many investors in the VC asset class may stand to benefit.

History

I’m not the first to point this out but historically some of the best performing investments have been made during down cycles. UBER, AirBnb, WhatsApp, and Instagram were all founded between 2008 and 2010.

2020 isn’t 2008.

The impact Covid-19 is having is unprecedented in a modern economy and there is a good chance that we are looking at deeper lows than 2008 brought us. We’re also likely looking at much more profound and permanent social change on the other side of this crisis. That said, many of the same factors that produced some of the strongest VC vintage years (2008+) are still at play today during the current crisis.

Entry Prices vs Exit Prices

This one isn’t rocket science (or modern portfolio theory). Based on a small sample size from the deals we’ve seen in the last two weeks it looks like entry prices (valuations) have come down ~30%-40% from the prior period. Its early but I don’t believe valuations have bottomed yet and I don’t see them coming back for a couple years. Deals done now and likely for the next couple years will be consummated at relatively low prices whereas exits in the successful companies will occur in 5-10 years when we are likely to be at the highpoint of a new business cycle. This dynamic creates natural tailwinds for funds deploying right now.

Talent

Missionaries, not mercenaries: During boom times in tech everyone wants to be a founder or a venture capitalist. Investment bankers, GSB grads, trust fund tech bros and others flood the system. While we try very hard during diligence to separate the truly committed from the tourists, it’s a hard task. During serious down turns the only people crazy enough to take up the mantle of founder are the people who are dead set on seeing the journey through to the end. Those are the people we want to back and its going to be much easier to find them for the next couple years.

Aggregation of talent: While raising capital is never as easy as it may seem from the outside, during boom times it is much much easier. The relative ease of raising capital entices great VPs of engineering, amazing individual contributor sales staff and top notch operations specialists to leave their companies and create competitors. Oftentimes they aren’t great founders but they can raise enough capital to spend 2-3 years building a second tier company. This is a double whammy in that it drains the best talent from the best companies AND it create short-term competitors to the top companies that just raise the costs of doing business. In a downturn great talent tends to aggregate in the best businesses and we see the formation of dream teams, which drives outsized returns.

Power Law Shifts

The impact of Covid-19 is net negative but it is not an equal opportunity villain. There are industries that are being crushed today and may never recover (next week I’ll discuss commercial real estate) but there are also sectors that have doubled or quadrupled over night and the funds that are lucky or prescient enough to be heavily invested in these sectors should expect to see great returns. In other words Covid-19 is shrinking the overall pie (bad) but it is dramatically increasing certain parts of the pie.

Covid-19 is accelerating major social changes in how we work, what we purchase, how we purchase and what we value. Some of the observed changes will ultimately revert to near pre-covid levels but many changes are here to stay and are going to create new massive businesses. Just as the last economic downturn lead to the creation of UBER and AirBnb, new ways for people to make money with their under utilized assets, Covid-19 will spawn new businesses. These twin effects (1) net negative impact on the economy and (2) a shift of where dollars are going should increase the number of startup failures but they should also increase the value of the startups that do succeed in the new environment.

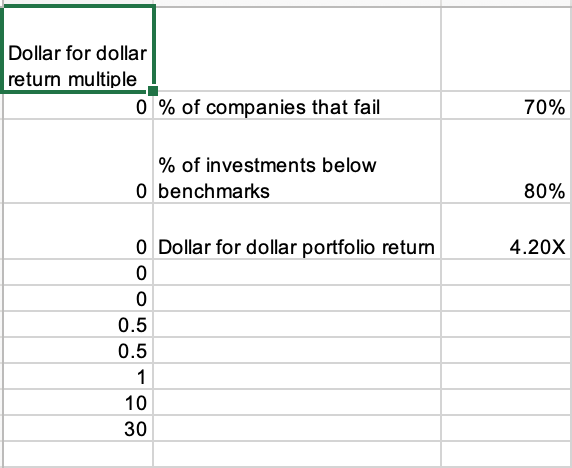

Lets look at a couple simple 10 company portfolio models that show how this effect might impact returns:

Pre-Covid Fund:

Post-Covid Fund:

As you can see, a post-Covid fund may have materially more bad outcomes but still outperform even a strong performing pre-Covid fund. These are obviously just models but they represent directionally how I expect VC return profiles to adjust.

Next week for Labyrinth subscribers I’ll cover the impending demise of commercial real estate.

And now for the Fathhome deck. Fathhome is building a really interesting waterless replacement for your washer and dryer. Cleaner clothes and a cleaner environment FTW

I don’t usually critique cover slides but this is a really plain snooze fest. It won’t change anything about anything but I would put a little effort into design.

“Sanitize your life” is a phenomenal attention grabbing phrase right now.

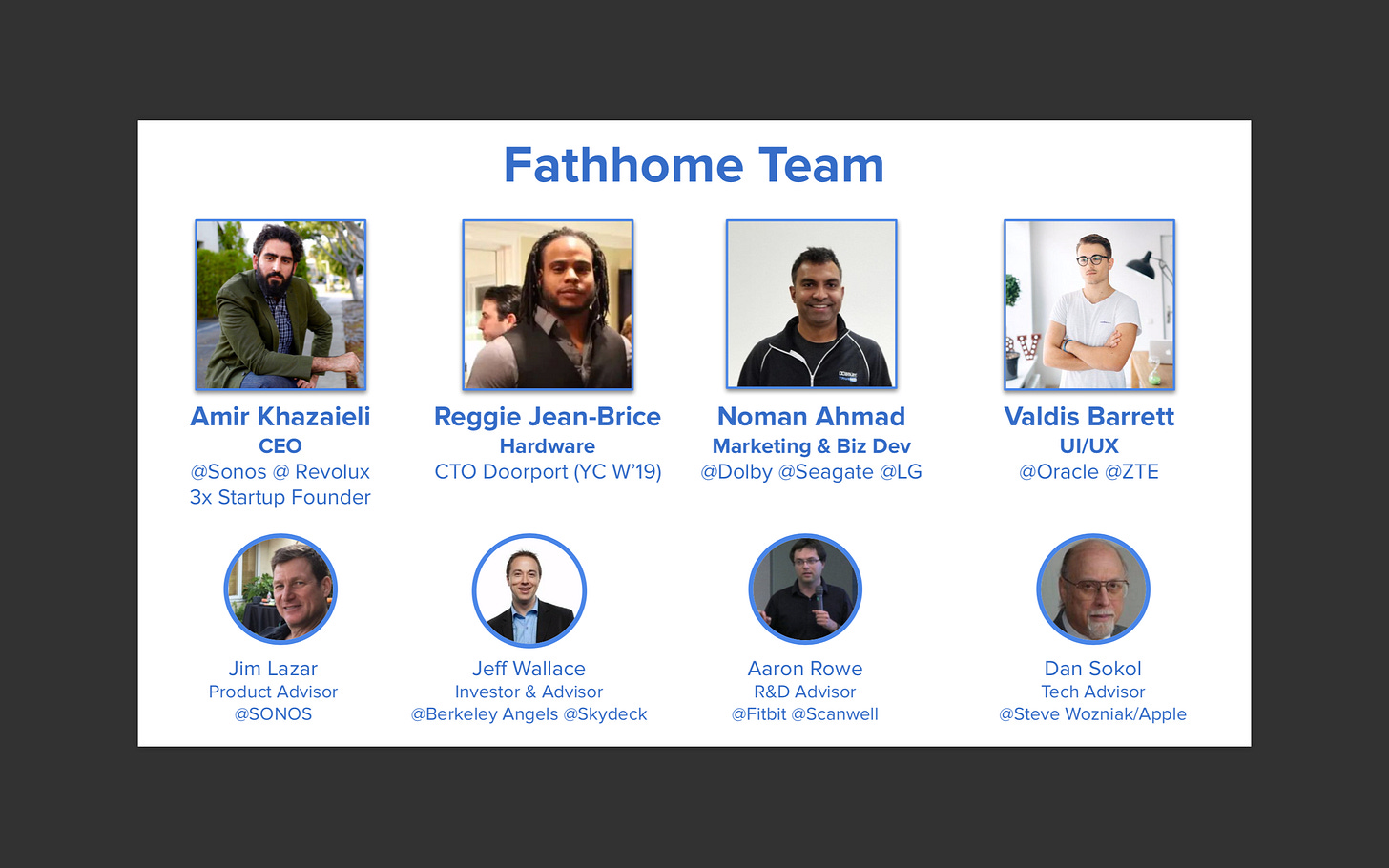

Team is pretty darn important, its not first slide important. Ideally I’d be able to evaluate your team in context but at this point I don’t know what problem you’re solving or how you’re going after it. I’d say the only time a “team” slide should proceed ever bit of info about your business is if you’re team includes a tech “celebrity”.

Elon Musk’s next deck is just a headshot and an ask but you need more.

This slide is good in that it orients me to the market you’re chasing… laundry and in that it connects me to a human. Human connection always helps. Its a little wordy but not bad.

I’d make this slide much shorter. The second two bullet points aren’t compelling and if you eliminate them you can make the story punchier. Just make clear traditional laundry leave germs behind unless you use harsh chemicals.

“Meet Mona” is confusing after the “Meet Nina” slide. I know Mona is your device but its not clear. I’d blow up the picture, focus on the device and make it the full slide but transparent. Make it clear Mona is a new hardware solution. Then just include a few bullets on the benefits. Saves money, no harsh/toxic chemicals, kills germs and eliminates odors. Those are the value props that resonate. Extending clothing life is nice but its non-immediate and hard to quantify.

At this point I’m still pretty skeptical that you’re offering a compelling value propositions… one that is significant enough to dramatically change consumer behavior. I mean I use traditional W&D and Dry cleaning and I haven’t really thought either process was “broken” in any way.

Competition slides are really hard to do well. This style is ok and lives or dies on the quality of the factors you choose for your X/Y axis. In your case, I think they are pretty reasonable as convenience and water free might be two of your top unique selling propositions, although cost and sanitization might be more compelling for your users.

B2B cleaning isn’t really a green field. Hotels, dry cleaners, uniform supply/service companies, etc have been doing sanitizing laundry for a long time. How big is that market?

For both the B2B and B2C side, you should give a back of the envelop idea of YOUR market opportunity. E.g. $15M Households * $300 per unit + 15M units @ $200 per year in consumables = ?

As I mentioned a couple slides earlier, I hear the value proposition you’re promoting but I don’t really feel it. What is it about the 15% of household above that is actually going to make them change a behavior that hasn’t really changed since since the early 20th century? Is this a solution in search of a problem?

Have you done any of these yet? Talking about what you’ve done is much better than talking about what you’re planning on doing.

What does the B2B business plan? How do you make money from these POCs or once POCs are completed, how do you make money from these partnerships?

Roadmap is helpful and a slide that I always like to see but I’d prefer something more granular. This slide looks more aspirational than a plan with dates set for POCs to roll-out and a pre-order campaign to launch. At this point your Q2 2020 should be fairly locked in.

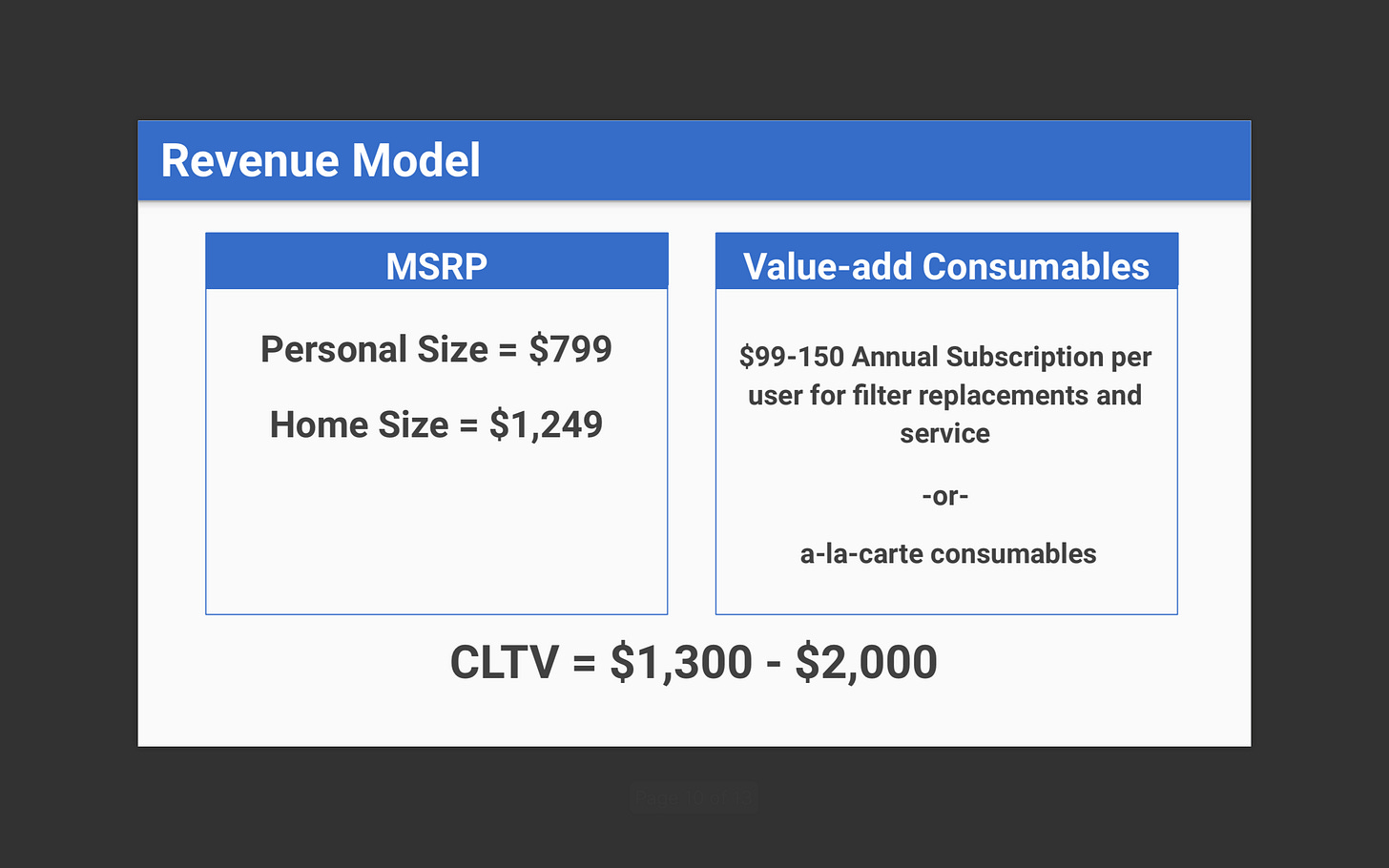

Since the majority of LTV is coming from the upfront hardware sale, we need to know what you BOM (Build of Materials) costs are and what margins are going to look like there.

Combined with a granular timeline / roadmap slide, these accomplishments can be much more powerful. They put everything in context.

Helpful use of funds slide, more info than most provide.

I go back and forth on whether I like the early vs. late tranche valuation as a mechanism to create a sense of urgency in investors. I’d like to see data if it helps rounds close faster. It can backfire. We’ve definitely seen similar schemes that were milestone based where we much preferred the risk/reward curve 6-12 months further down the road.

Overall

This works ok as a teaser deck but it leaves many questions unanswered and its not particularly inspiring. I keep coming back to the fact that laundry doesn’t inherently feel like an unsolved problem and this deck doesn’t do much to change my mind around that. You are too early for customer data, which would be one way of addressing this. “You may not feel like its a problem but look at all of this organic demand.” Since you can’t say that, you need to find a way to tell me the story of the person who is going to run out and buy this and then tell all of their similarly situated friends about it. Is there a story to be told around multi-family housing real estate developers who own hundreds of thousands of units without washer and dryer hook-ups and how they can make more money putting your machines in their units than operating a coin-op laundry facility or something equally compelling? You really need to tell those stories here.

Questions for Fathhome:

What is the real hair on fire problem that you are solving for someone? Is this mass market or is it really just for gyms and for affluent apartment dwellers who don’t want to use coin-op laundry facilities?

Is this actually a washer and dryer replacement? Do you remove dirt and soil from clothes or just kill germs? Do you remove wrinkles from clothes? If just kill germs, how do you convince people to buy an additional device and do you expect them to use the Washer and Dryer AND your device in sequence?

How large of a device do you need to handle a normal households worth of clothes, can you handle that volume?

The Covid-19 angle is interesting. Can you rescue used PPE? I suspect that testing around this will take too long to be immediately relevant but could be a good B2B segment and would be more salient for people evaluating your company today.

Is the demand for dry cleaning 0 right now? Will it recover post Covid-19 or will work from home trends make the dry cleaning side of the business an infinitely harder sell as the market contracts?

You listed a bunch of competitors, some in the waterless space, how are you differentiated?

Show me the economic breakdown for consumers doing (a) dry cleaning vs. your solution and (b) laundry vs. your solution. Show me the same for your B2B clients.

If you’re super successful how do you manufacture these things at scale? What does your Capex look like in a strong demand scenario?

If you have any questions you’d like to see the Fathhome team answer, leave them in the comments below.

Jake, your comments Are spot on. Also I’m not convinced that there’s a market for this product. I realize they’re early here, but the limited effort put into the deck makes me question the commitment level of the team to move this company forward.