Deck review: Medios

Market sizing, long-term vision, and the value of phenomenal headlines.

Before we get to this week’s deck review, I wanted to put in a quick plug for our new Q&A series. Whether you’re a founder trying to decode VC email etiquette, an aspiring VC or LP getting into the nuts and bolts of portfolio construction, or a startup employee having a crisis of faith, we’re here for you. Send us your questions with this Q&A form and we’ll answer it in a future edition of Ask The Venture Folks.

Now… on with the show. :P

Market sizing is kind of my pet issue. It’s ridiculously important and virtually nobody gets it right the first time. In our last deck review, I slipped in a paragraph near the end about how to talk about market sizing in pitch decks:

Ultimately, good businesses are pretty easy to explain. Treat slides about business models or financial projections accordingly. (You'll share the more in-depth stuff during due diligence anyway.) Once you make the business simple to understand, investors get to make a much tougher call: whether or not you can execute.

Today I have a deck that does it right. Bhargav Sosale graciously shared his seed pitch deck for Medios. It contains real lessons about market sizing, long-term vision and strategy, and the value of phenomenal headlines.

You can see the full deck here. Let’s dive in.

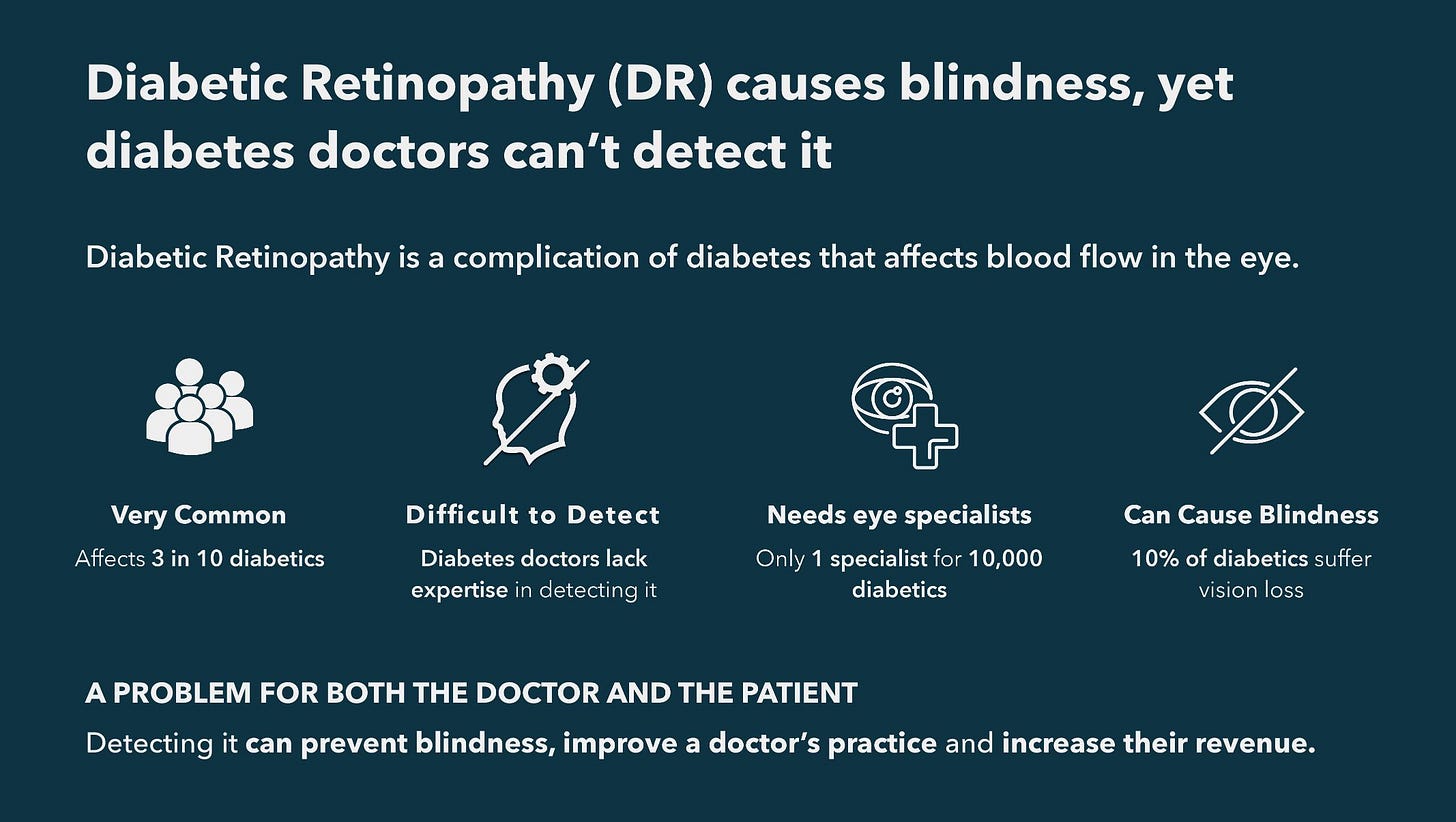

I know in one line what the problem is and everything in the body supports that headline. The footer — “A problem for both the doctor and the patient” — is arguably introducing another idea into this slide, but in this case it’s more like an extension of the headline. And it sets up what it would mean to solve it.

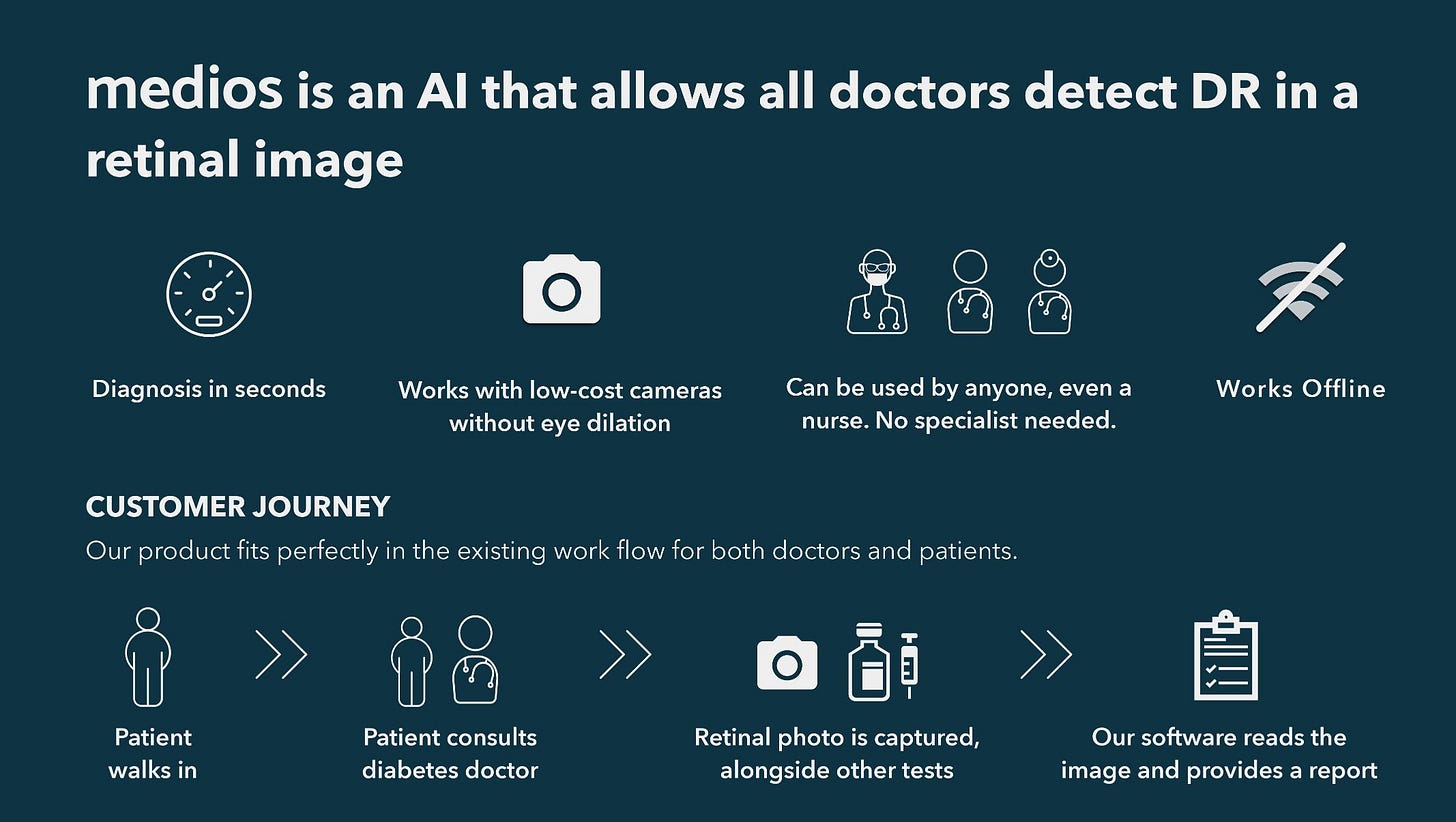

The overarching idea of this slide: These are the barriers to changing the status quo (and we’re about to knock them down).

Everything on this slide maps to something set up on the previous slide.

Specialists are inconvenient and time-consuming -> Diagnosis in seconds

In-house specialists are expensive -> No specialist needed

Telemedicine solutions aren’t good enough -> Works offline

No good end-to-end hardware/software solution -> Works with low-cost cameras without eye dilation

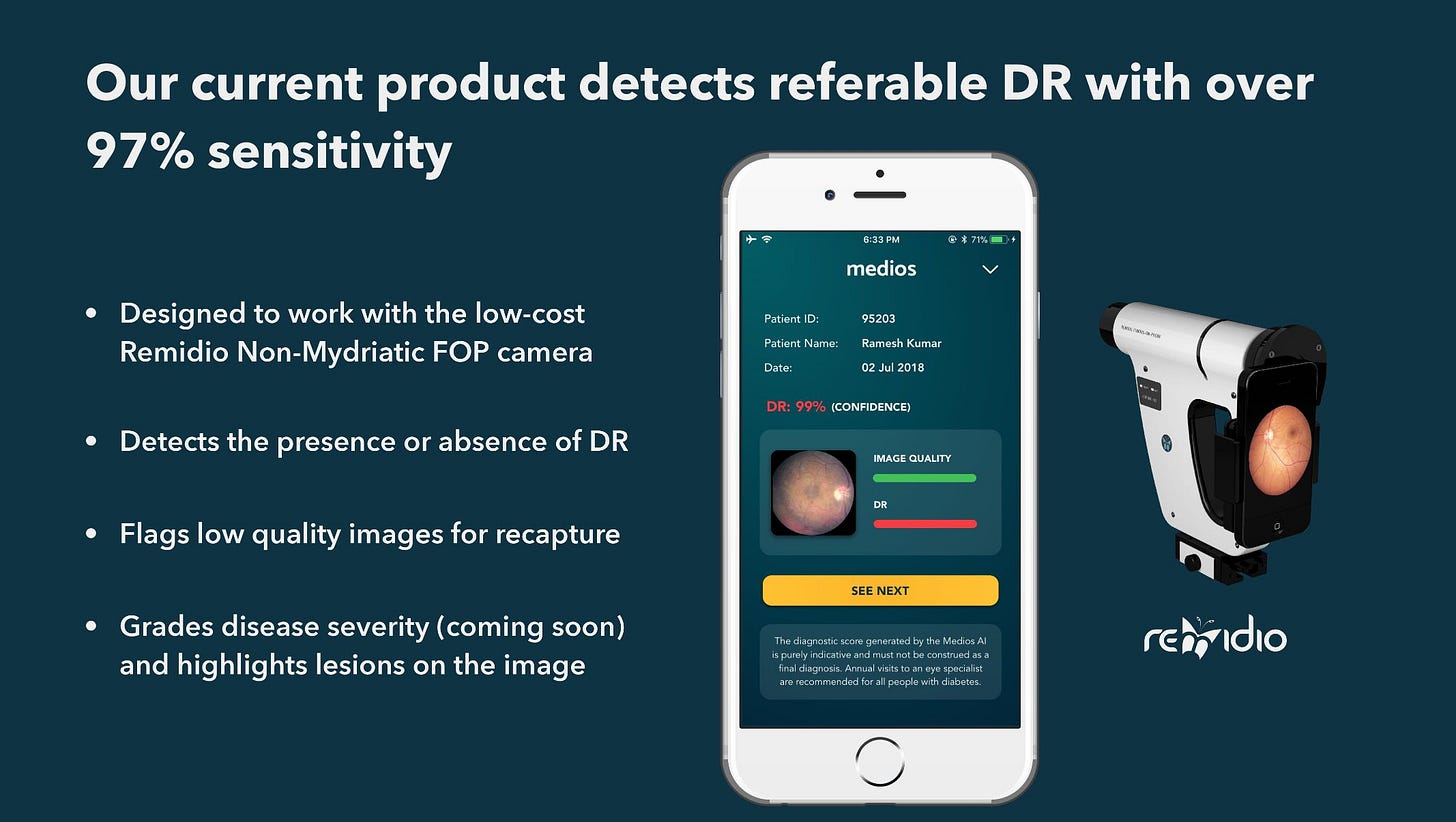

And then this slide packages up the previous slide as a discrete product.

So far, every message in this deck has been delivered with absolute precision. In fact, that value is expressed in everything from the actual content to the simplicity of the fonts, colors, and iconography.

It’s also expressed in the headlines. Go back and read them again:

Diabetic Retinopathy (DR) causes blindness, yet diabetes doctors can’t detect it. The current methods of detection do not work in today’s world. Medios is an AI that allows all doctors to detect DR in a retinal image. Our current product detects referable DR with over 97% sensitivity.

That’s incredible information density. That’s Carta-level headline writing. If you cropped out the bottom 80% of every slide, you’d still know basically everything about the company. In contrast, if you can’t deliver your deck’s message with just the headlines, you have room for improvement.

The rest of the deck’s headlines are just as good, but let’s move onto market sizing.

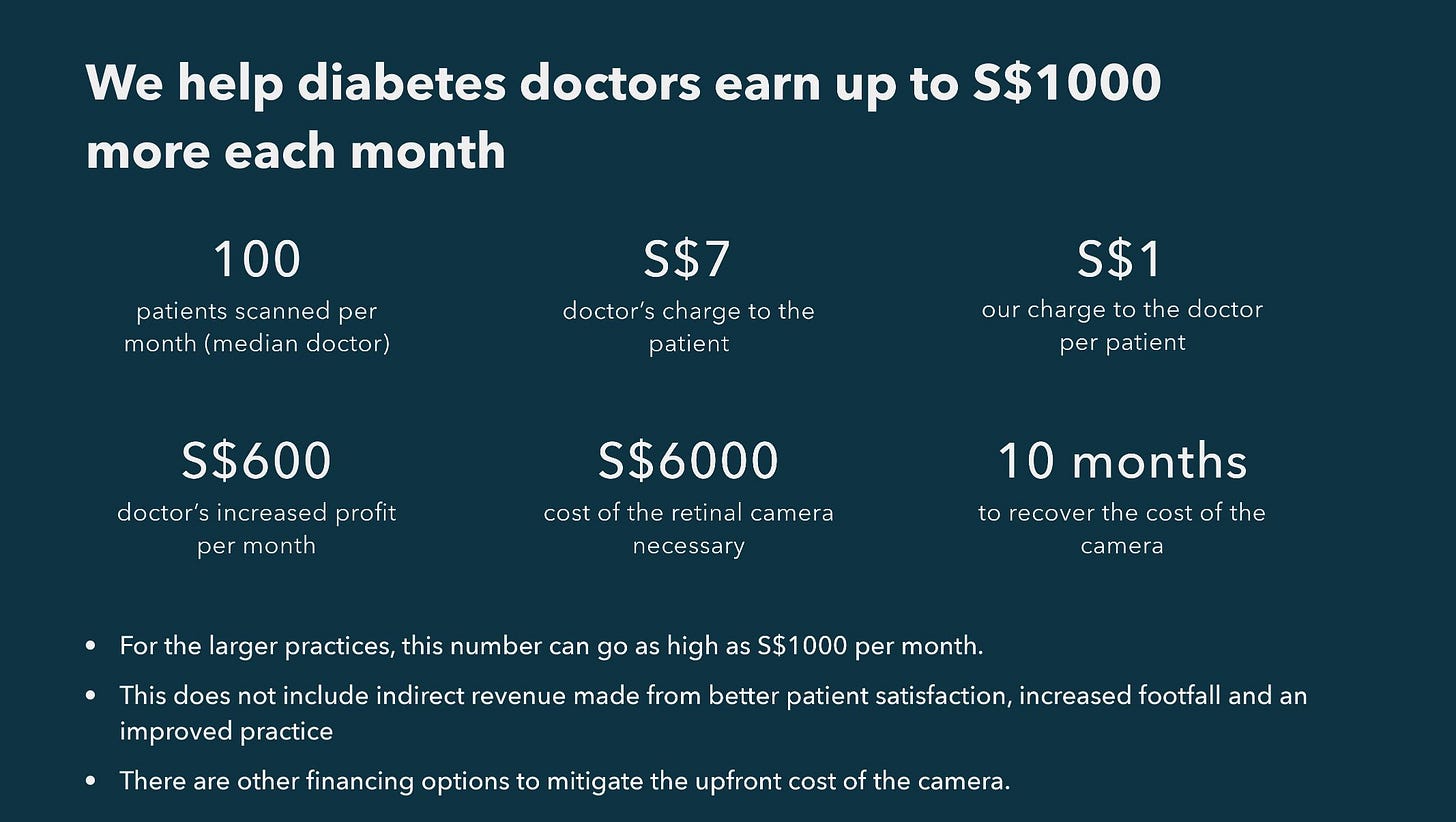

I like this slide a lot. Two things jump out to me.

The data in the top half of the slide are good starting points. However, they aren’t valuable on their own. What’s important is that they feed into a larger story about market sizing; future slides do in fact build on this foundation.

The “India is the right first market” bullet points do not feel like throwaways. They are representative of deeper strategic thinking and a framework that you could conceivably use to grade new markets: Do we understand the market? Do we have distribution access? What are the rates of diabetes (or any other disease) in this geography? What’s the regulatory environment like?

The Marketing Channels and Sales Channels pieces of this slide aren’t very helpful. But I don’t see how the deck would benefit from improving them; going into detail about them on this slide at the expense of the other elements would have been a poor ROI activity. Sometimes it’s important to leave things out.

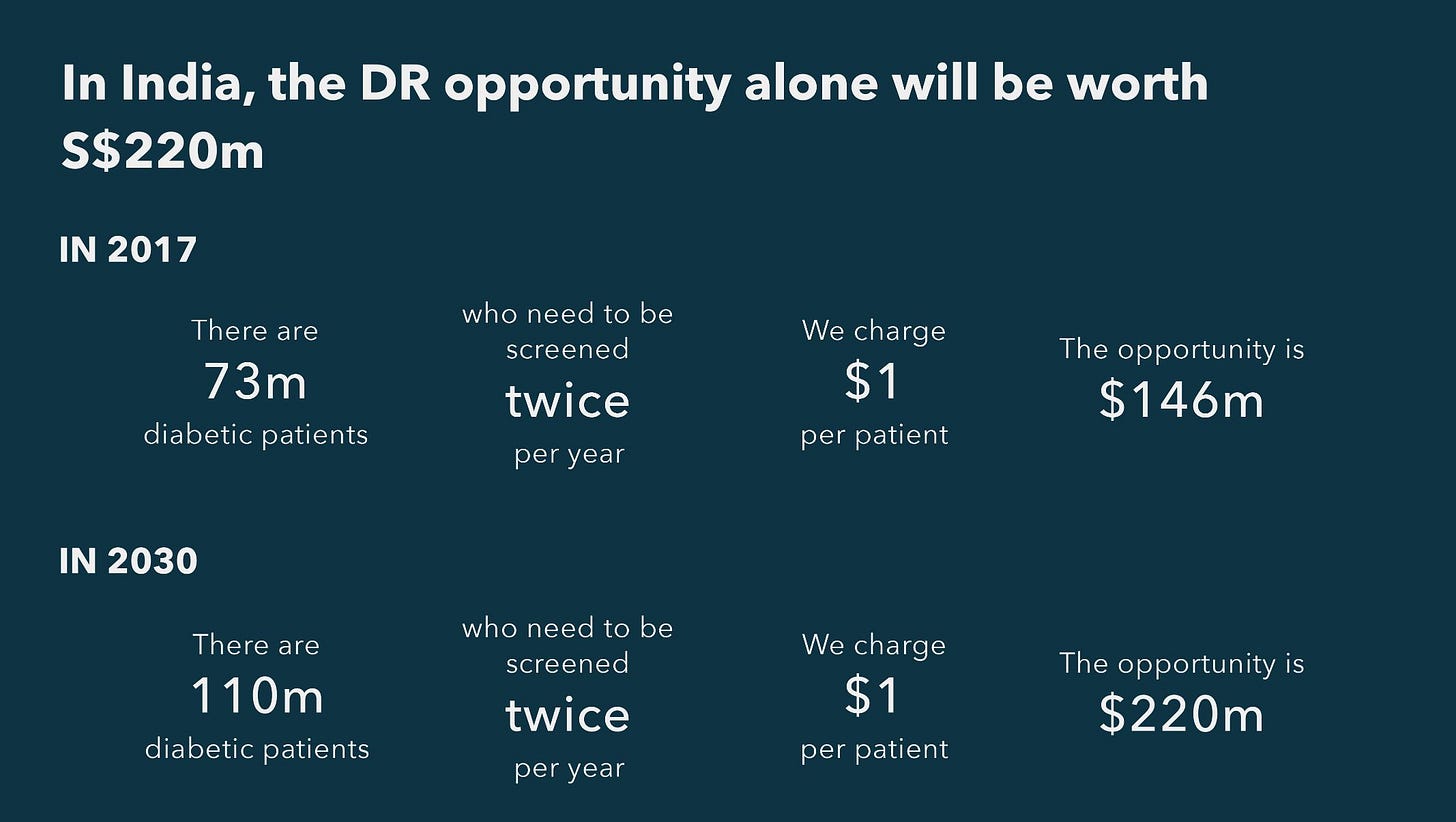

This is practically a platonic ideal of bottom-up market sizing. The first slide walks through the unit economics. It answers two questions: why doctors would want to use it and what a typical practice will contribute to Medios’s business.

The second slide uses the same $1 per patient to feed its market opportunity calculation. It’s in the right ballpark: Venture scale (if you use the $100 million rule of thumb) in its very first market.

You might be thinking that this doesn’t look like a venture scale opportunity. Billions or bust, right? I disagree. That’s TAM-centric thinking. What the team is doing here is much more precise (there’s that word again): They’re laying out the economics of a distinct customer segment, building out a business plan based on an immediately actionable goal, and pursuing a GTM strategy that fits that goal.

Customer-centric, bottom-up market sizing starts with your customer’s business model, figures out your corresponding unit economics, and expands from there. These two slides are a perfect illustration of how to do that.

Having said that, of course there’s a long-term vision. I’m going to touch on a few more slides that illustrate that.

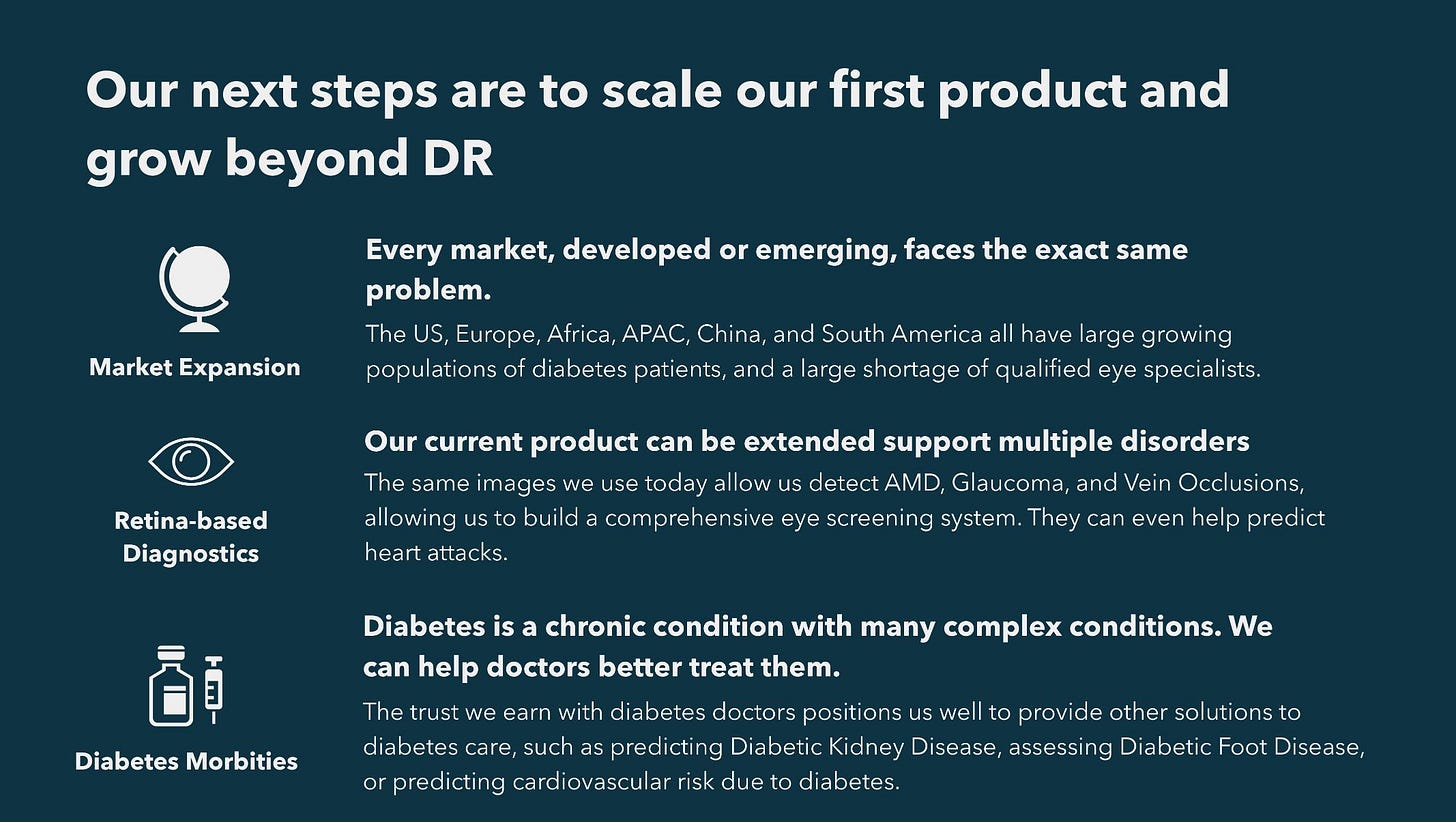

This slide is doing a bit of box-checking and is not particularly insightful, but it’s important to assure investors that the team is thinking about the global opportunity.

These two slides are essentially a deeper dive on that map slide. They chart a vision for future expansion into other geographies AND expansion into other pathologies.

Laying this out does not violate the axiom that startups need to focus to win. These slides are clearly about the long-term vision and strategy and how it builds on winning in their first market.

“Every market… faces the exact same problem” -> What we learn in India will help us expand into other geographic markets.

“The same images we use today allow us to detect…” -> The same data we gather in solving the Diabetic Retinopathy problem will give us a head start on new product development.

“The trust we earn with diabetes doctors positions us well to provide other solutions…” -> The reputation we earn with our first product will transfer to adjacent markets within healthcare.

The key to a compelling long-term vision is that it builds logically on the outcome of your near-term strategy.

This does not mean that your story should hop from miracle to miracle. Your beachhead market should be venture scale on its own.

Rather, this is where you get to ask (and answer) the question that animates so many people in startup and VC world: “What if this works?”

That’s all for now. You can find me on Twitter. And you can share this post or subscribe to The Labyrinth right here.

It may be a corner case, but when I think of why market sizing is not important I think of Carta. Is that the exception? Loving the deck breakdowns here, so much to learn from this. Thanks !