This week we are sharing the complete deck we used to raise Alpha Bridge Ventures Fund I. More importantly, Chris Douvos, the Super LP, agreed to do a slide by slide commentary for us so that you get the unvarnished LP’s take on our story.

Traditionally VC fund managers keep their decks very close to the vest which makes it hard for emerging managers to see how other VCs market themselves to LPs and makes it nearly impossible for founders to see how venture firms pitch themselves. I think this does a disservice to both groups.

Emerging managers find it difficult to benchmark themselves, learn from one another and pick up best practices from other fund managers. While there is a plethora of content around deck construction for founders, there is very little for VCs. This makes it harder for emerging managers to get started and probably serves as a small contributing factor to the homogeneity of VCs.

Founders need to understand all of the incentives to which their prospective investors are subject. At the end of the day VC’s serve two different customers. We serve our limited partners who give us capital to invest AND we serve the founders we back. While the interests of founders and LPs are often aligned it isn’t true that all of their interests are aligned all of the time. The potential misalignments are important for founders to understand and the best way to do this is to see how their prospective investors are pitching themselves to their LPs.

Is your VC’s pitch to their LPs consistent and harmonious with the story they’re telling you? You should find out.

Before we dive to this week’s deck review, I wanted to put in a quick plug for our Q&A series. Whether you’re a founder trying to decode VC email etiquette, an aspiring VC or LP getting into the nuts and bolts of portfolio construction, or a startup employee having a crisis of faith, we’re here for you. Send us your questions with this Q&A form and we’ll answer it in a future edition of Ask The Venture Folks.

Now on to the Alpha Bridge Ventures deck teardown! Be gentle dear readers!

Chris Douvos (CD): In a typical week, I might review between 10-18 decks. Typically, I spend between 10-15 minutes perusing the slides. In my review, I focus on team, strategy, process, portfolio, and performance (in that order) in an attempt to understand the firm’s sustainable competitive advantage and repeatability.

Jake Chapman (JC): Repeatable sustainable competitive advantage is definitely the main point I hope to communicate but I’m surprised that performance, while a priority, is lowest on the totem pole. I guess because it is a lagging indicator.

CD: A great slide! It teases the team, sustainable competitive advantage, portfolio validation and repeatability. I’m excited to dig in!

JC: Be still my heart! I wish I could have been this concise and focused on what matters throughout the whole deck. Alas, this might be our high water mark.

CD: Oh no! The dreaded industry slide. Why do people waste a page so early telling me what I already know? MOMENTUM KILL

JC: Mea culpa! If someone had asked whether I thought Chris already knew all of this info, obviously the answer is yes. It makes me wonder though, do I include a slide like this in decks sent to folks not as familiar with the venture asset class as Chris or do I drop it all together? Food for thought.

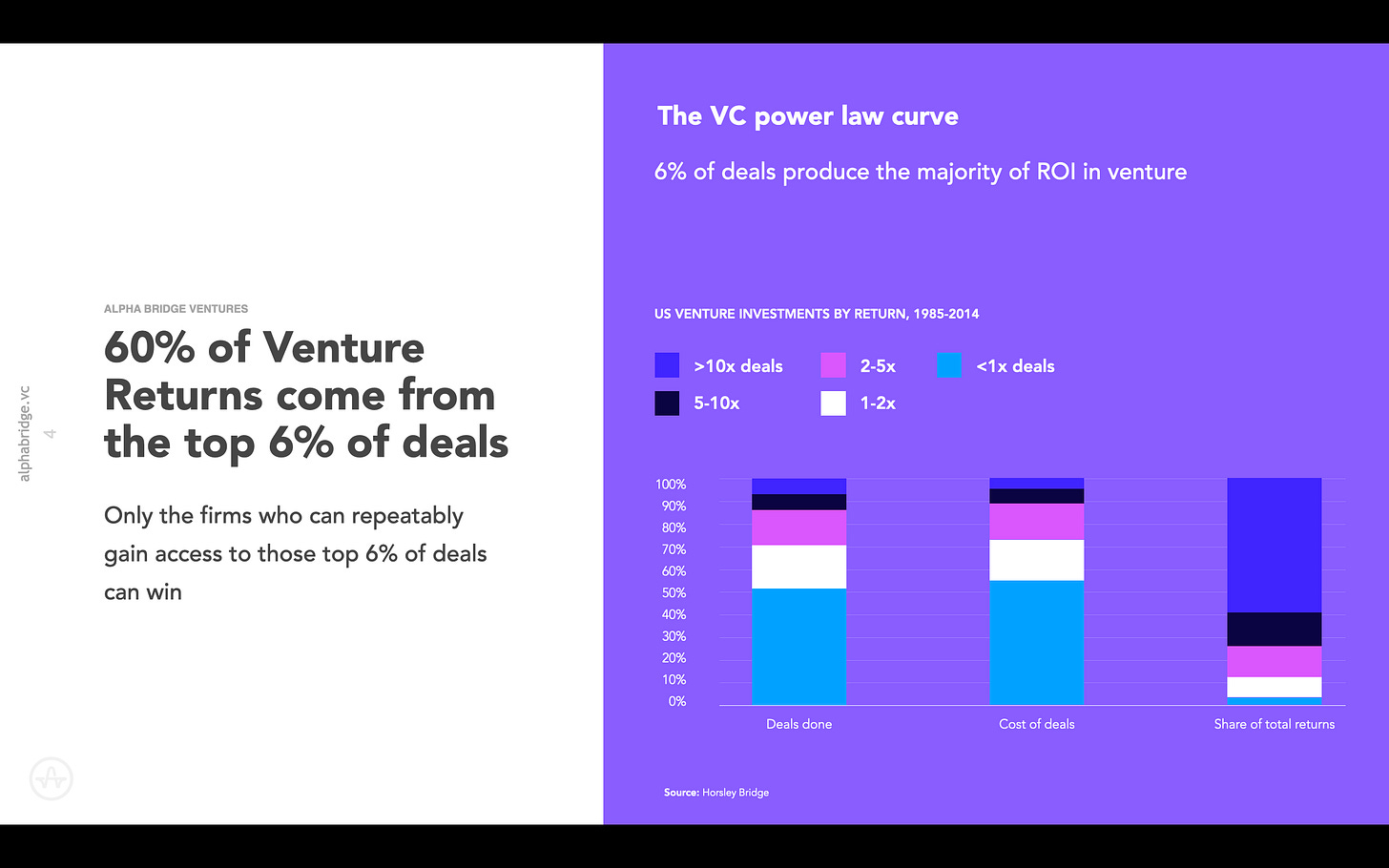

CD: Why is this slide interesting or important to the flow of your story? This is a 25 year old insight. Yawn

JC: Ouch, but 100% fair. This slide does somehow manage to feel wildly out of place like I randomly dropped it here while at the same time just reiterating what was said on the last slide.

CD: This slide and the two previous slides are in sooooo many slide decks. These slides don’t add to my understanding of you.

JC: Again, 3rd slide on the same topic, a topic, Chris didn’t even need 1 slide on.

Ugg. Its amazing how many iterations we went though on this deck (scores) and how many hours we spent polishing it (100+) that there are still huge glaring mistakes like this.

CD: The deck could easily start right here!

JC: I really am a fan of this framing (pats self on back)

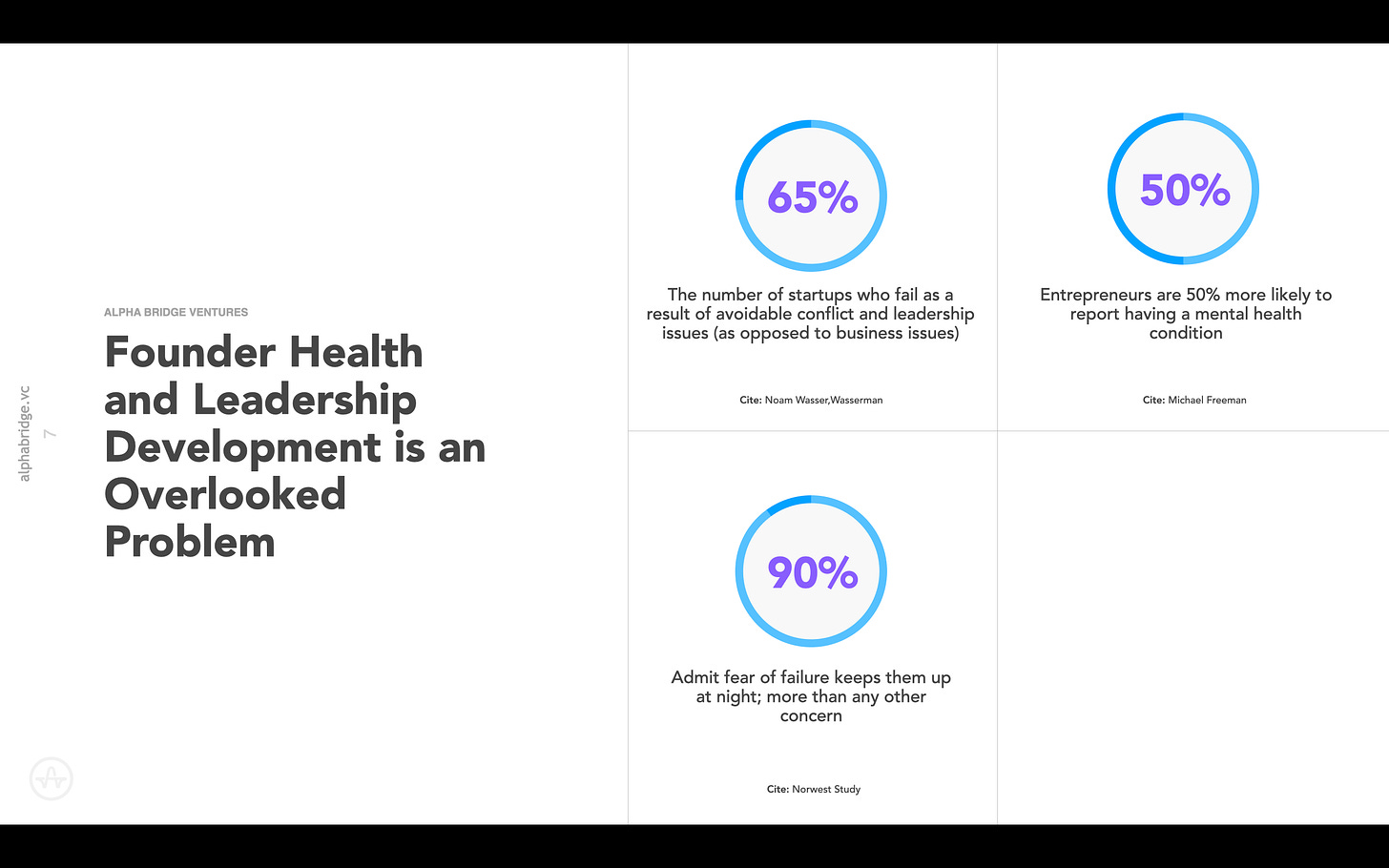

CD: Now this is an interesting slide. You’ve started to frame a problem I don’t hear about all that often and are giving some data that supports your assertion.

This seems like an area where the right team can be valuable to a start-up, build a reputation as a valued partner leading to enhanced deal flow over time.

JC: Our key unique insights all start right here on this slide. Its insane we buried it this deep.

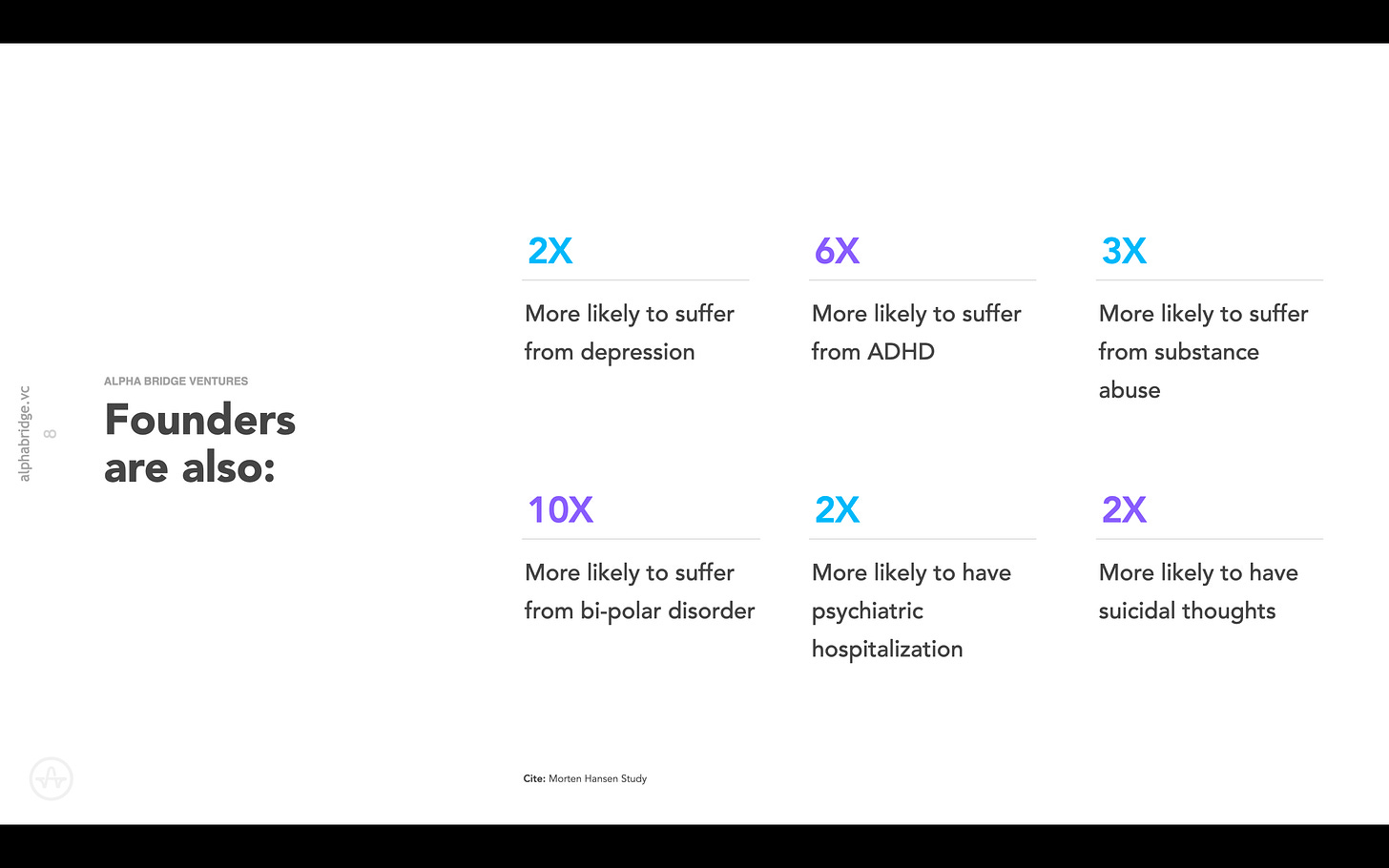

CD: Yikes! This actually makes me unsettled. Maybe condense all of these into an elegant bullet point on the previous slide. Use the rest of the data in oral commentary during the meeting.

JC: I know right! This shit unsettles me too. What boggles my mind is that every single VC isn’t obsessed with these numbers. If we all generally agree that teams are critical, why isn’t this top of mind for everyone. Enough editorializing though, I have agonized about whether or not to include this slide. These numbers are shocking in a way that I think helps drive our story. On the other hand, I’m worried I might help convince LPs to invest in things that aren’t manned by ticking human time bombs.

Great advice from Chris here to pull out some of the scary details and save it for the narrative.

CD: Ok, we’re now almost 10 pages in and you’re alluding to “we” but haven’t told me who you are. As LPs we’re investing in blind pools managed by people who have strengths, weaknesses, behavioral footprints, etc. Its not like we get to invest in a market or product - the product for us is YOU!

Why do people bury the “product” so deep in the deck? This is the case in 75% of decks I see - The team slide should be among the first few.

JC: I’ll be honest here, I think I bury the team slide because deep down I don’t feel particularly personally compelling or worthy. I know our strategy is unique and compelling and in a real tangible way I have structured our deck so that I can hide behind the momentum of my story.

** For those playing along at home, here is the video link**

CD: The video was cute but recapped what I’d seen on the last few slides and didn’t add much in terms of specifics while taking me out of the flow of the deck.

JC: But but but, once we’ve paid for a video we need to use it somewhere right? Wrong. Ok, it’s toast.

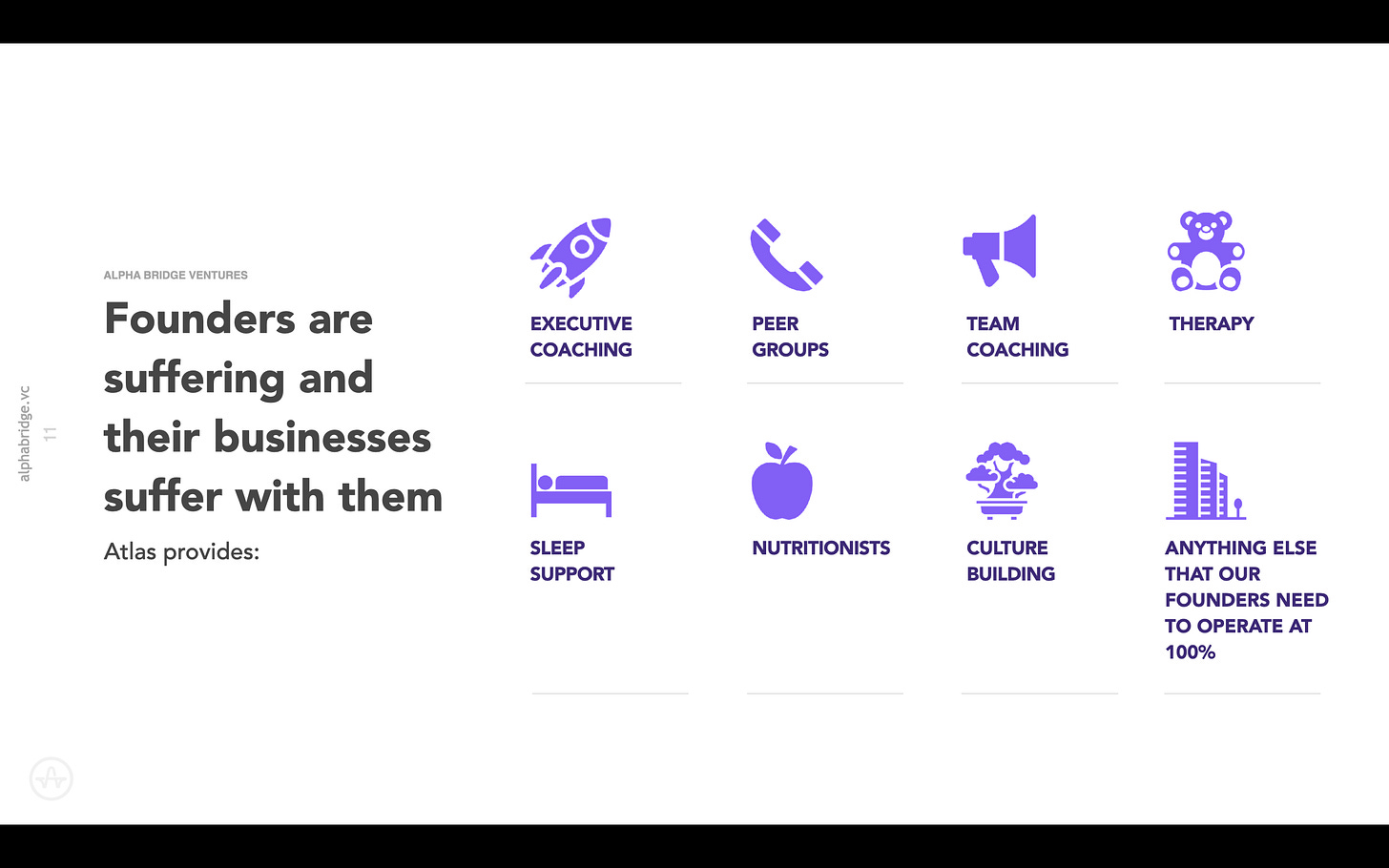

CD: Finally, a sense of what you’re offering. I am intrigued about how you deploy the offerings / programs and clearly see value potential from a deal flow and post-investment perspective. Tell me more.

JC: Its hard to capture the details in a deck because the service offering is pretty custom BUT you are 100% right we can, at the very least, outline the process of how we work with founders.

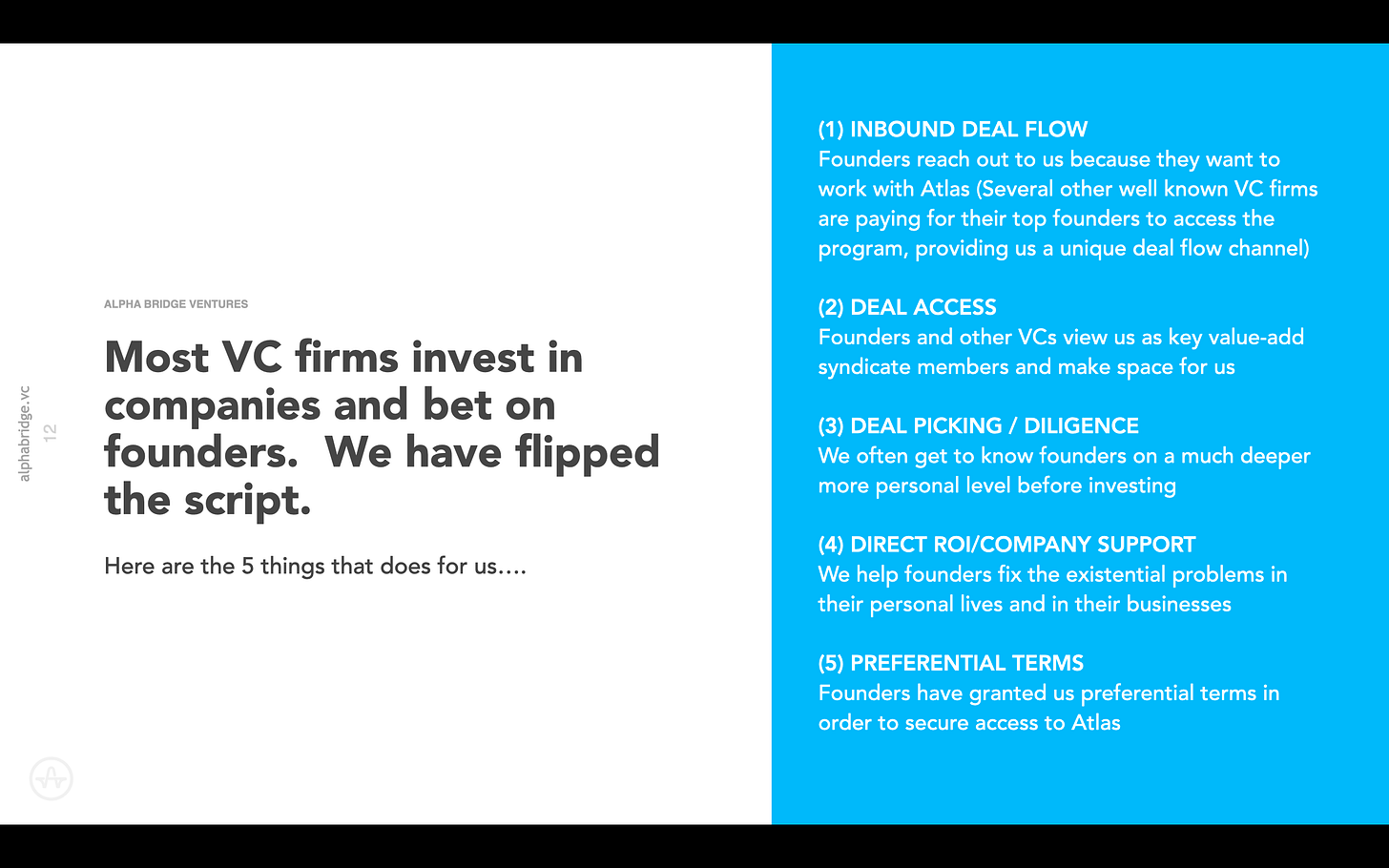

CD: OK!

JC: When we launched I honestly only thought about #3 and #4 above. Everything else has been gravy.

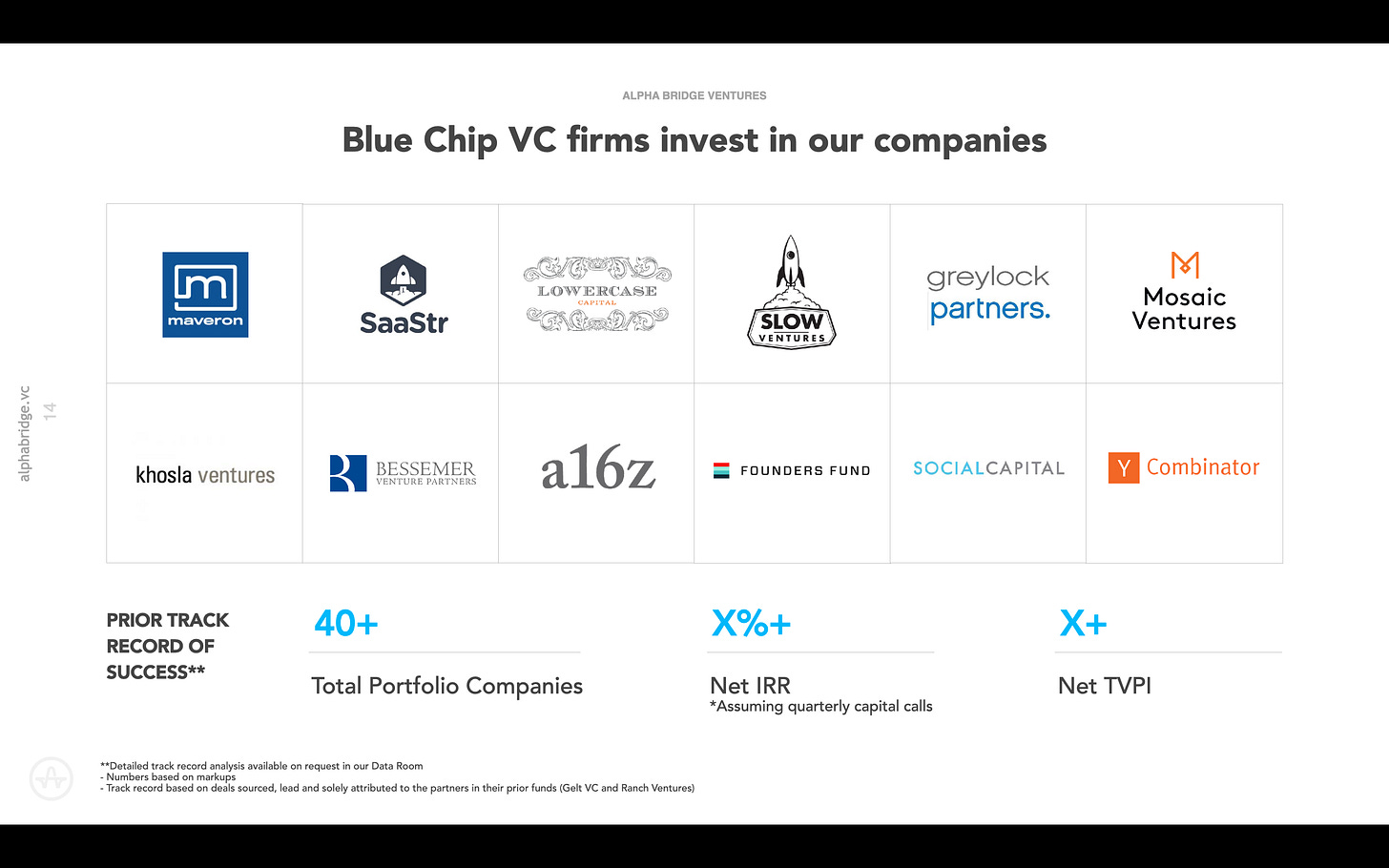

CD: Everybody has some version of this slide. Some people love it but I think it can cut both ways as people have strong views about who’s on the slide or not.

Follow-on rate is much more interesting to me than a logo slide of investors I may or may not trust.

JC: I hate these slides. I’m not A16z or Chris Sacca and I don’t ask founders who else is in the round until the very end so why should I throw a bunch of other people’s logos up there to make myself look good? Moreover, everyone wants/brags about proprietary deal flow (a totally bogus concept) and then throws one of these slides up to show how their “proprietary” deal flow ends up with them investing in the same companies as everyone else.

So, why is the slide here? Because it seems like a lot of people want to see it. If anything I’d rather have a slide showing how 30% or 50% of my deals are totally outside the SV echo-chamber. Call me by MY name.

CD: Is this a full list? A selection? How much did you invest and what is it worth today?

JC: Fair questions. It is just a selection. We included the full details in our appendix. On second thought this slide seems pointless. Not enough info to be helpful. My thinking was include a few recognizable company logos because it looks nicer than an embedded spreadsheet but in retrospect this is a slide where substance needs to supersede form.

CD: While I’m sure it’s in the oral commentary, it would be great to have a couple bullet points that talk about how you were able to deploy your service offering to get into a deal or build value.

JC: When we put the fund I deck together we actually didn’t have case studies of the founder support program, these were all from our prior funds. The founder support program was probably only 6 months old when we really started fundraising and the beta-iterations were…. not polished. I actually can’t wait to “show and tell” with how things have turned out over the last 18 months.

CD: FINALLY!!! I care most about who you are and why you’re (uniquely) best positioned to provide value to founders / teams, etc.

JC: Don’t look too closely. I’m not worthy. Based on Chris’ feedback I think this slide needs to be much higher up in the deck AND maybe should be broken into a dedicated slide for each key-person because if we’re each the product then there needs to be enough info on each person to advertise their awesomeness and not just a short blurb.

CD: Any particular reason for these two sectors? Do they lend themselves well to your voodoo? Do you have deep experience there? I can see consumer, but have less of a sense for deep tech, which can be a hard spot to play.

JC: Good question and unfortunately you’re asking it because we’ve done a terrible job setting it up in the deck. The initial thinking is that the exit & risk reward profiles of deep tech and consumer are almost perfectly complementary AND they happen to align with the interests of the GPs. My opinion is that GPs shouldn’t be investing in great companies, they should be investing in great companies that they are personally passionate about. There are so many investors today, if you, as a GP, aren’t completely enamored with a company, then there is a GP out there who is a better fit. Passion + Profitability (or solid business) is the formula for success for both founder/company fit as well as investor/founder fit.

I have a ton more to say here but it probably touches on fund II strategy and then maybe I run afoul of the securities laws against general solicitations so I’ll just tease that there is more to follow here on sector expertise and focus.

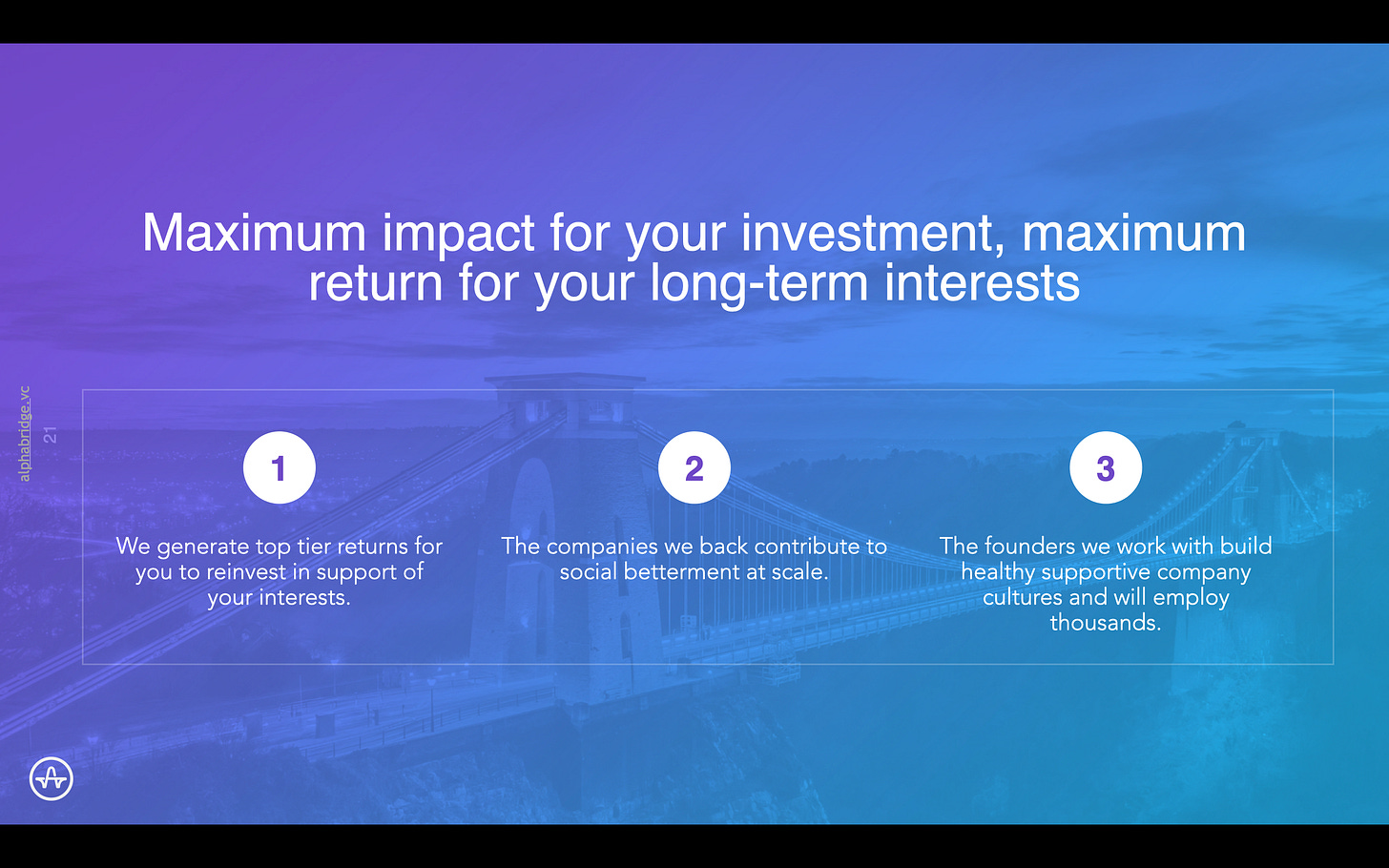

JC: We now talk about quadruple impact: (1) Direct impact on the health of founders, (2) direct impact on company cultures and the wellbeing of our portfolio companies’ employees, (3) investment in diverse founders (we’ve ended up with well over 50% of our investments in diverse founders), and (4) investment in mission oriented founders who are in some way making the world incrementally better.

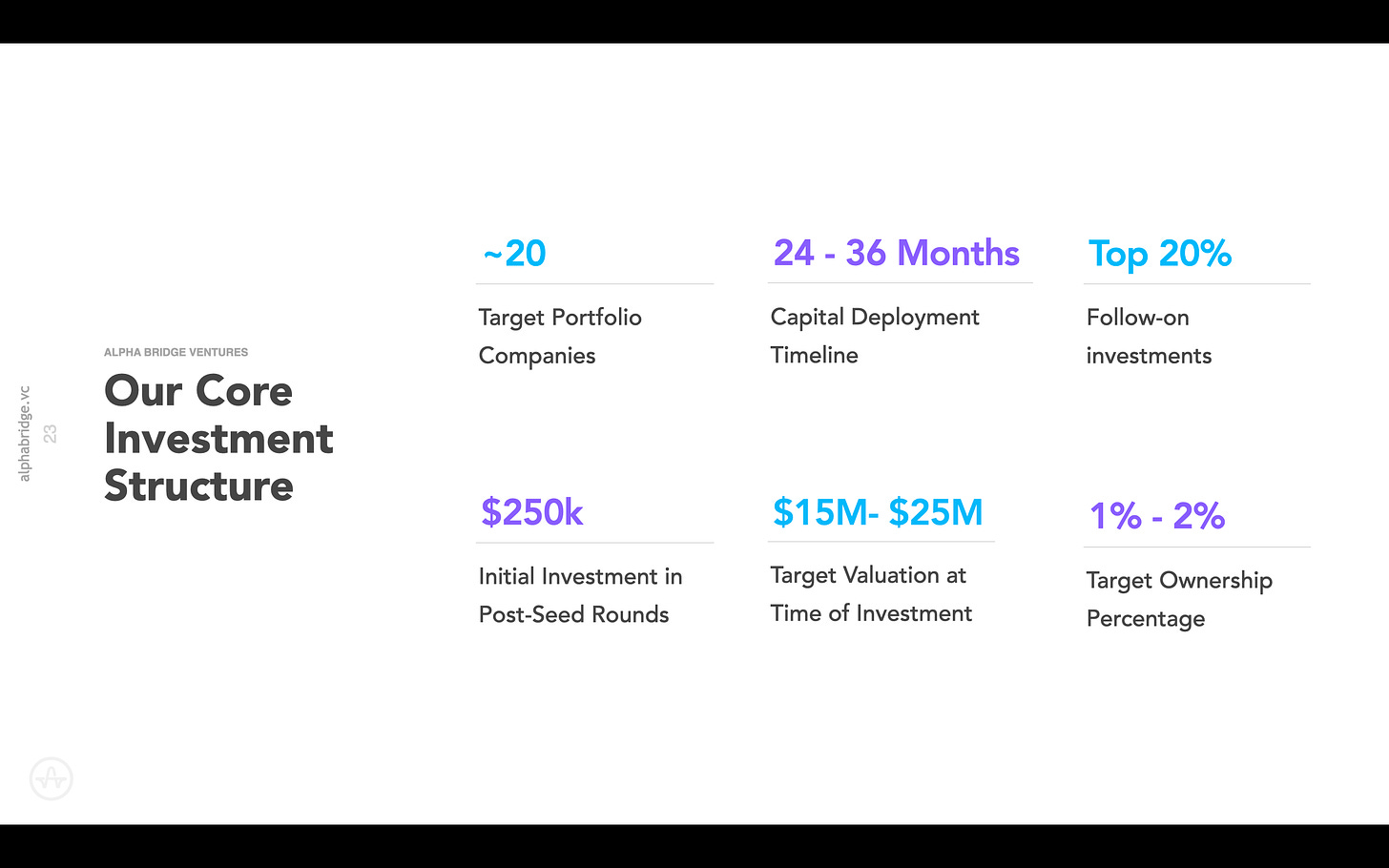

CD: There is a doctoral dissertation to be written on VC firm portfolio construction, but the question here is what do I need to believe to believe that this construction will generate a 3X (or better return)? What exit assumptions are embedded here?

It feels like the entry valuation and ownership (is that at exit?) make this tough.

JC: Our thinking here is that with a tiny fund 1% ownership at exit is actually enough to return the entire fund multiple times over with one $1B+ exit.

We’ve set ourselves up where with several moderate (non-unicorn) exits or a single unicorn exit we can almost certainly return 3X net to LPs. The criticism is fair though because this slide doesn’t explain any of the thinking behind the portfolio construction. Maybe this slide should actually be followed by an embedded spreadsheet which models out planned portfolio construction?

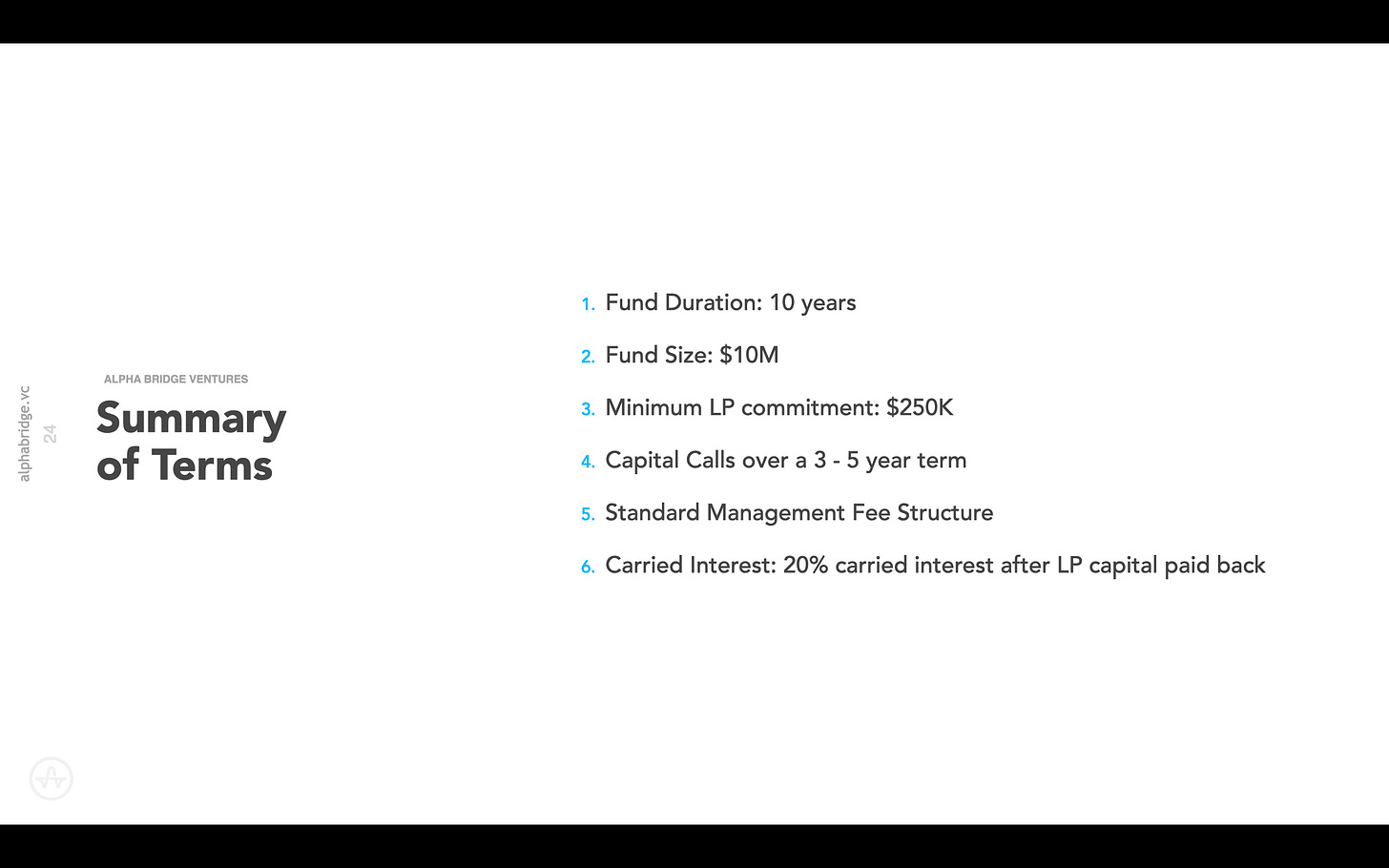

CD: On management fee, “standard” can be different to different folks: Do you have a step-down? Do you charge fees on committed capital or called capital? etc.

JC: Management fees are based on committed capital and step-down beginning in year 3. The step-down is somewhat complex though so I was worried about a wall of text when the reality is that we net out to 2/20 (or less) over the life of the fund. With a little effort I could be more explicit here without getting too into the weeds.

CD: At the end of this deck I am intrigued by the Atlas platform and its different enough to be interesting but I’d hoped for more detail or any kind of proof / insight into its value and effectiveness. Don’t just tell me, SHOW me!

JC: With the fund I deck it was hard to show rather than tell but even so we did a poor job. There was much more we could have done here to focus on what matters and to cut out all of the duplicative stuff. It makes me indescribably happy that Chris is at least intrigued by what we are building but obviously we could have done a better job.

I hope this exercise is helpful for other emerging managers and aspiring emerging managers. I am always happy to help new folks who are thinking about walking down this path and am always looking for feedback on how I can do better. If you fall into either camp, feel free to reach out at jake@alphabridgevc.com or leave a comment here.

top 3 items: 1) track record / metrics (if you have one), 2) people / team (if you don't), 3) why you're different from everyone else. everything else is window-dressing.

Thanks for doing this guys. Would love to see more VCs and LPs be transparent like this. Great for the ecosystem. Kudos. (And love your mention of a push for a Gene Roddenberry style future, Jake! Feels like recent years have taken us in the wrong direction but let's not give up the fight for that future someday!)